Budget 2016 – 17 Impact on logistics Industry: Emphasis on tax compliance GST rollout

INDIRECT TAXES

The most anticipated budget of the government is finally here. The Finance Minister, Mr Arun Jaitley presented the budget in an unconventional format, laying emphasis on the key projects of the Government and the various challenges it faces in meeting these initiatives. The FM has clarified that GST will put in place a state-of-the-art indirect tax system.

India is all set to introduce a tax reform from 1st April 2016, the goods and services tax (GST). Apart from creating a unified market across India, GST will help make India’s manufacturing competitive by cutting high logistics and warehousing costs.

A supply chain is the network of all the individuals, organizations, resources, activities and technology involved in the creation and sale of a product, from the delivery of source materials from the supplier to the manufacturer, through to its eventual delivery to the end user. The supply chain segment involved with getting the finished product from the manufacturer to the consumer is known as the distribution channel.

Let us understand the GST taxation real impact in logistics business

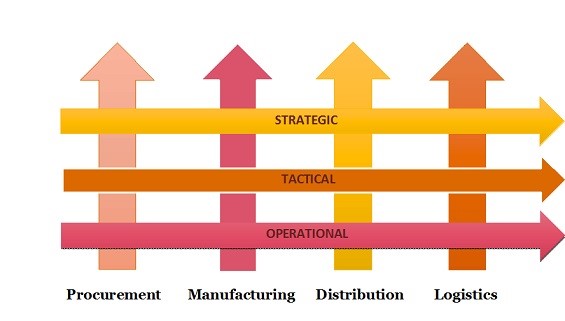

Supply chain management (SCM) is the oversight of materials, information, and finances as they move in a process from supplier to manufacturer to wholesaler to retailer to consumer. The three main flows of the supply chain are:

- Product flow,

- Information flow and;

- Finances flow.

How it works/Example:

A company’s production operation contains material input components, each of which incurs a cost which is recovered in the price of the finished product. Much of market competition is based on keeping the prices of finished products as low as possible without sacrificing quality. For this reason, supply chain management (SCM) attempts to bridge this gap effectively by closely monitoring the cost a company pays for materials and from whom the materials are being procured. In addition, SCM monitors the operational procedures from start to finish in order to identify costly and unnecessary procedural steps.

Current State:

Let’s look at two scenarios that shows how a Consumer goods (CG) manufacturer sells it goods to a distributor and how that impacts the location of the warehouse in a non GST environment. The “input tax credit “at the source the logistics cost in landed cost component have been ignored for simplicity.

Scenario A: Stock Transfer Sale

| Supply Chain Point | Landed Cost (in Rs.) | Margin (in Rs.) | Input VAT Credit (in Rs.) | Price Before Tax (in Rs.) | VAT | CST | Total Tax (CST+VAT) | Final Price (in Rs.) |

| Firm | 1000 | 500 | 0 | 1500 | 0% | 0% | 0 | 1500 |

| Warehouse | 1500 | 0 | 0 | 1500 | 4% | 0% | 60 | 1560 |

| Distributor | 1560 | 500 | 60 | 2000 | 4% | 0% | 80 | 2080 |

| Retailer | 2080 | 1000 | 80 | 3000 | 4% | 0% | 120 |

Scenario B: CST Sales to Distributors

| Supply Chain Point | Landed Cost (in Rs.) | Margin (in Rs.) | Input VAT Credit (in Rs.) | Price Before Tax (in Rs.) | VAT | CST | Total Tax (CST+VAT) | Final Price (in Rs.) |

| Firm | 1000 | 500 | 0 | 1500 | 0% | 2% | 30 | 1530 |

| Warehouse | 0 | 0 | 0 | 0 | 0% | 0% | 0 | 0 |

| Distributor | 1530 | 500 | 0 | 2030 | 4% | 0% | 81.2 | 2111.2 |

| Retailer | 2111.2 | 1000 | 81.2 | 3030 | 4% | 0% | 121.2 | 3151.2 |

In scenario two the final price (Rs. 3151.2) for the consumer increases in comparison to the final price (Rs.3120) paid by the customer in the first scenario. To maintain the same price (MRP) for the end customer, the firm has to take a hit on its margin so that the distributor and retailer margins are preserved. This happens because unlike VAT, CST cannot be claimed as “input tax credit”.

The above two scenarios clearly show that distributors will like to buy from a warehouse in the same state rather than buying directly from the firm in another state. This type of provision in the current tax structures has forced firms to locate warehouses in all the states where they do business.

Future State:

With the introduction of GST, the tax barriers on cross-border sales will be removed. The tax disincentive of cross-border sales due to the presence of CST will be eliminated.

| Supply Chain Point | Landed Cost (in Rs.) | Margin (Rs.) | Input VAT Credit (in Rs.) | Price Before Tax (in Rs.) | GST | Total Tax (GST) | Final Price (in Rs.) |

| Firm | 1000 | 500 | 0 | 1500 | 4% | 60 | 1560 |

| Warehouse | 0 | 0 | 0 | 0 | 0% | 0 | 0 |

| Distributor | 1530 | 500 | 0 | 2030 | 4% | 81.2 | 2111.2 |

| Retailer | 2111.2 | 1000 | 81.2 | 3030 | 4% | 121.2 | 3151.2 |

The supply chain network can be made smarter so that the operational costs are minimized and efficiency is improved.

Currently, each of India’s 29 states taxes goods that move across their borders at different rates. As a result, freight that moves across the country is taxed multiple times. Worse, there are long delays at inter-state checkpoints, as state authorities review and examine freight and apply the relevant taxes and other levies.

Supply Chain Planning Decisions:

With GST regime, the supply chain network design would be purely based on logistics cost & customer service and provides a greater flexibility into Supply & Demand matching. This would lead to club many small warehouses and have bigger, fewer, and highly efficient warehouses. This also would reduce the share of unorganized sector in warehousing.

Further, the firms in the unorganized sectors, too, would be expected to improve their service levels if they intend to successfully grow in the likely shape up or shape-out competitive landscape.

India has one the highest logistics cost as a ratio of GDP compared to other countries of the world. Also transportation, inventory and warehousing contributes upto 70%of the total spend on logistics in India.

Country Logistics Cost Comparison:

| Country | Logistics Cost/ GDP | Activities by 3PL/ logistics Activities |

| India, China | 15-20% | <10% |

| US | 9-10% | 60% |

| Europe | 10% | 30-40% |

| Japan | 11% | 80% |

The post-GST regime is, in fact, likely to offer many more unseen opportunities for unorganized entities to tie up or collaborate with established companies. This could ultimately result in a win-win scenario for both the collaborating parties and the industry at large.

In addition, GST also improves the transit and consequently delivery times because of state border crossing are likely to be simplified.

This Year’s budgets is also welcomed by the IT, TELECOM & ELECTRONICS SECTOR

In an evident push for “Make in India” manufacturers of IT, telecom and electronics sector shall benefit from the following key proposals:

(a) Manufacturer of tablet computers shall benefit as BCD, excise duty and additional duty of customs on parts, components and accessories used in the manufacture of tablet computers are exempted. Further, excise duty of 2% without CENVAT credit and 12.5% with CENVAT credit shall be levied on tablet computer.

(b) Excise duty on manufacture of mobile handsets including cellular phone with CENVAT credit is increased to 12.50%.

(c) BCD is exempted on High Density Polyethylene (HDPE) for manufacture of telecommunication grade optical fibres or optical fibre cables.

(d) BCD is reduced from 10% to NIL for some categories of digital video cameras and BCD is reduced from 5% to NIL on parts and components for use in the manufacture of these categories of cameras

(e) Special Additional Duty (SAD) is exempted on many goods (except populated PCBs) for use in the manufacture of information technology goods such as computers, laptops, printers, monitors, projectors, etc.

Keep tuned in for more highlight on Budget 2016 its direct impacts on manufacturing and logistics business in India.

The most foreseen spending plan of the legislature is at long last here. The Finance Minister, Mr Arun Jaitley introduced the financial plan in an eccentric arrangement, laying accentuation on the key ventures of the Government and the different difficulties it confronts in meeting these activities. The FM has cleared up that GST will set up a best in class aberrant expense framework.

India is good to go to present an assessment change from first April 2016, the merchandise and enterprises charge (GST). Aside from making a brought together market crosswise over India, GST will make India’s assembling focused by cutting high coordination’s and warehousing costs.

An inventory network is the system of the considerable number of people, associations, assets, exercises and innovation required in the creation and offer of an item, from the conveyance of source materials from the provider to the producer, through to its inevitable conveyance to the end client. The store network portion required with getting the completed item from the producer to the customer is known as the appropriation channel.