Let’s understand the GST Impact on Logistics Companies:

Author: Mr. Venkat Reddy B. – AVP Strategy, Biz Analyst & Audit – NWCC LLP

The unified tax regime, that is, GST is coming into effect from 1st July 2017. GST will bring about some significant but welcome changes, especially for logistics sector. NWCC is tuned up to meet the new situation which by and large should be simpler and good for the business.

In the present scenario, companies feel the need to have one big warehouse at a central location which might serve multiple states leading to decrease in the number of warehouses resulting in reducing the logistics costs. GST will facilitate this order without adding, rather reducing, the cost.

Impact on Warehousing: Key end-user industries are remodeling their supply chain strategy post-GST, thereby directly impacting logistics industry. Supply chain strategies for FMCG, Pharmaceuticals, Consumer Durables, Automobiles, and e-commerce type of industries post-GST would be as follows:

– Based on operational efficiency, as against tax considerations

– Direct deliveries to large dealers; reduce C&F agents

– Larger zonal warehouses; reduce smaller ones

The major Challenges that lie ahead are to realign the evolving client needs such as relocation, consolidation (scaling up) and closure of smaller warehouses. Substantial investment will be required in the development of compatible systems and technology for automation at a larger scale. Because that will be necessary in order to cater to multiple clients from a central location.

Impact on Road Transport: Cost of transportation should be lower due to the following factors:

- Efficient inter-state transportation

- Higher asset-sweating

- Input tax credit availability

- Increase in tax on freight services, but to be passed on to customers

- Narrow price differential between organized and unorganized segments

- Single service provider for all distribution requirements

However, the challenges to reassess fleet size and a mix of vehicles to cater to evolving client needs would remain pertinent.

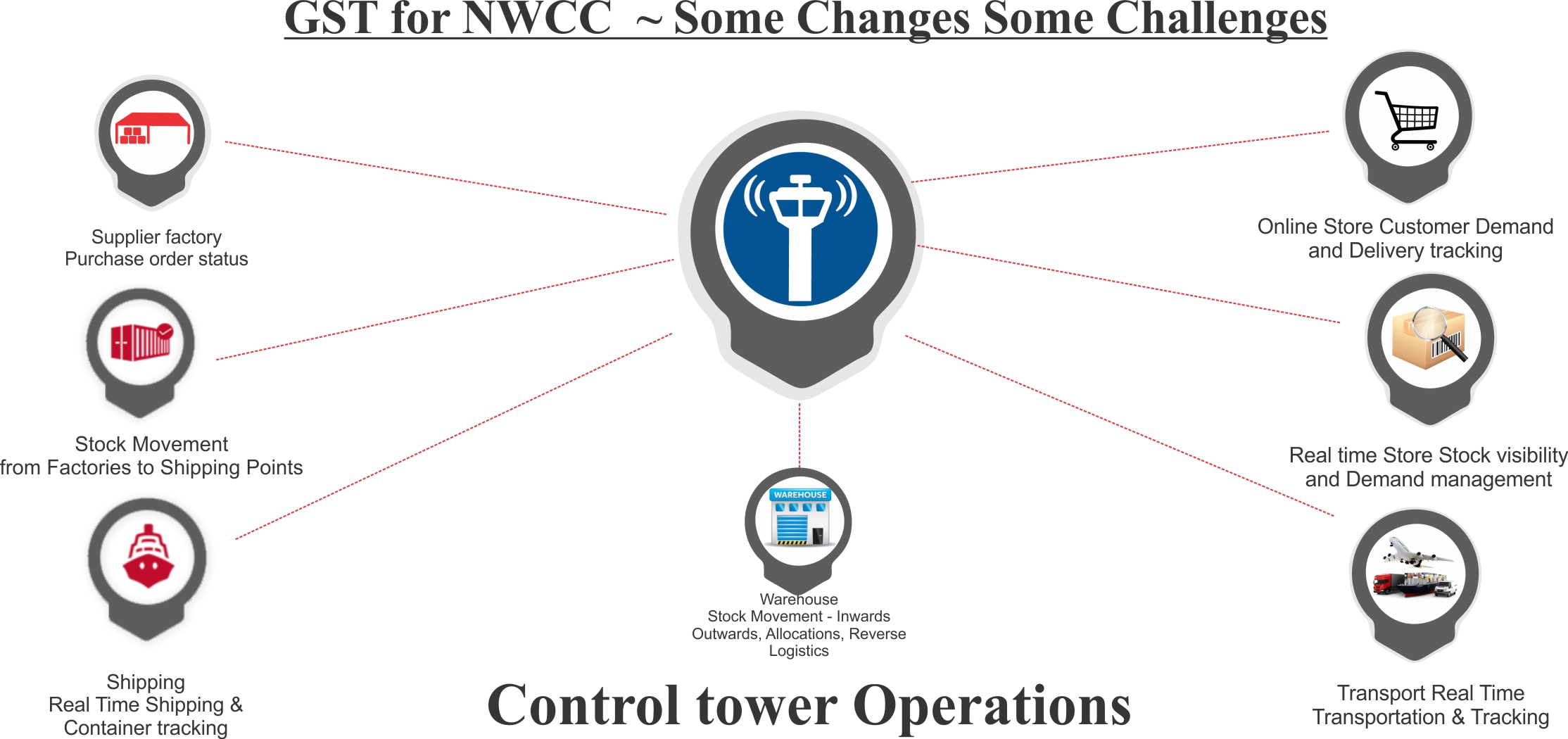

To support the customers in smooth GST transition

NWCC has set up a control tower at Head Office, Gurugram to assist the clients till restructured their warehouse locations and provide complete visibility of primary and secondary transportation with help of technology. It will help an organization to optimise the use of space, fleet and better distribution planning thus reducing overall logistics costs.

Control tower functions would be:

Major Functions of Control Tower would be

- Integrating primary-secondary transportation & warehousing supply-chain network with IT/ERP connectivity.

- Track & Trace, EPOD etc.

- Demand planning and order creation activity

- Issue & Event management

- All activities of beginning phase

- Invoicing Control

- Backhaul Management

- Real time Dashboard Visibility

- Transport Optimization

- Analysis and statistics

NWCC – Post GST Preparation

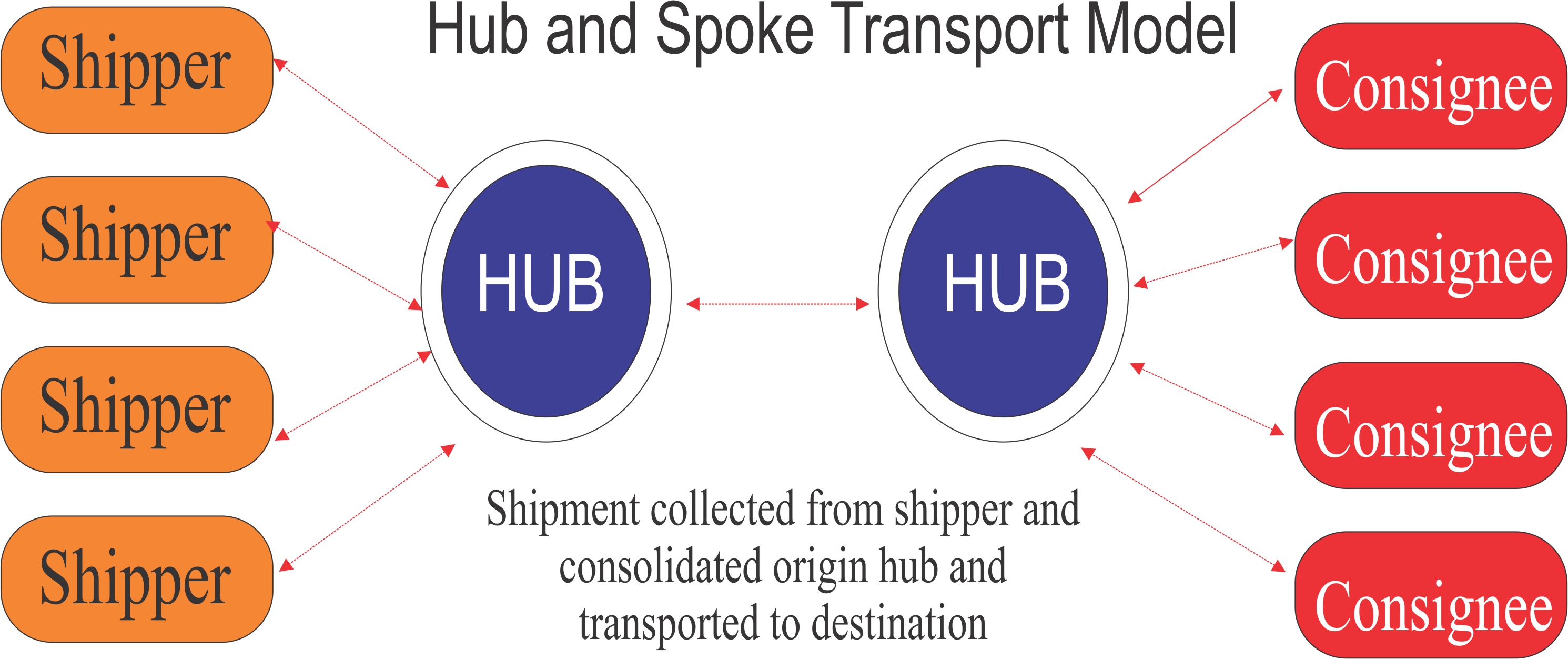

The implementation of GST will facilitate the emergence of key hubs in major locations and spokes in smaller locations, near to the customers, to allow streamlining of processes.

NWCC investing heavily and planning to set up such Hubs/Multi-user facilities in major cities and spokes in tier two and three cities to ensure secondary movement restricted to the distance covered within lowest TAT.There will be at least one spoke at each 300 to 400 kilometers radius (one-day transit/service time)

NWCC is in the process of building GST-ready warehouses across four locations (Gurugram – 1.00 lakh Sqft, Bhiwandi – one lakh Sqft, Bangalore – 1.00 LakhSqft and Guwahati – 1.5 lakh Sqft) in India.

A warehouse in Gurugram can cater to northern states. One in Bangalore can cater to southern states altogether and so on. This will result in the smooth transportation of goods to regional hubs, and from there to distribution centres.

The Hub and Spoke model would help customers with

- Consolidation and Outsourcing

With the increase in the availability of organized and efficient service provider, there is a possibility of consolidation. Also, this leads to the outsourcing of their logistics operations (3PL & 4PL) to logistics service providers so that the companies can focus on their core competencies (products).

- Reduced Turnaround Time

Truck drivers in India clock an average of 250-280 km per day as compared to the world average of 500 km per day. Majority of the time is spent in clearing papers in state borders and truckers easily spend nearly 40% to 50% of their travel time as idle time at check posts. With GST, lower interstate compliance and reduced paperwork is expected resulting into faster turnaround time for trucks and quicker delivery of goods.

- Higher Truck utilisation

When trucks will reach the destination quickly, say in 30% lesser time than usually taken in the present scenario, the utilisation of trucks will increase. A truck which now doing 4 trips a month between Kolkata and Delhi can do 5 trips a month. This eventually will lead to better operating economics for the fleet owner and will boost the profitability.

PEOPLE: Skill set upgradation and service levels

With a sudden spurt in the business activity, the industry might face a shortage of skilled and technically qualified workforce in the short term. Hence, to cater to this need, attention must be given on building up the skillful workforce.

TECHNOLOGY : Automation

Because of the fewer warehouses, the warehouses can be ramped up and equipped with state-of-the-art technology to facilitate long-term benefits. Latest warehouse management systems (WMS) and modern robotics can be used for the effective and efficient warehouse management.

Request a free consultation on GST Tax implication on your industry at http://www.nwccindia.com/contact/