GST impact Transport and logistics (T&L) sector

What to expect

The registration, payment and refund processes under GST will be routed through a centralised common portal set up by GSTN. The common portal will act as an interface between the taxpayers, authorities, banks, RBI and accounting authorities. At the back-end, the portal will be integrated with the IT systems of the central and state governments. The GSTN will be linked to the government databases to verify the data submitted on the GST portal by the taxpayer at the time of registration or filing of returns.

Opportunities for T&L sector

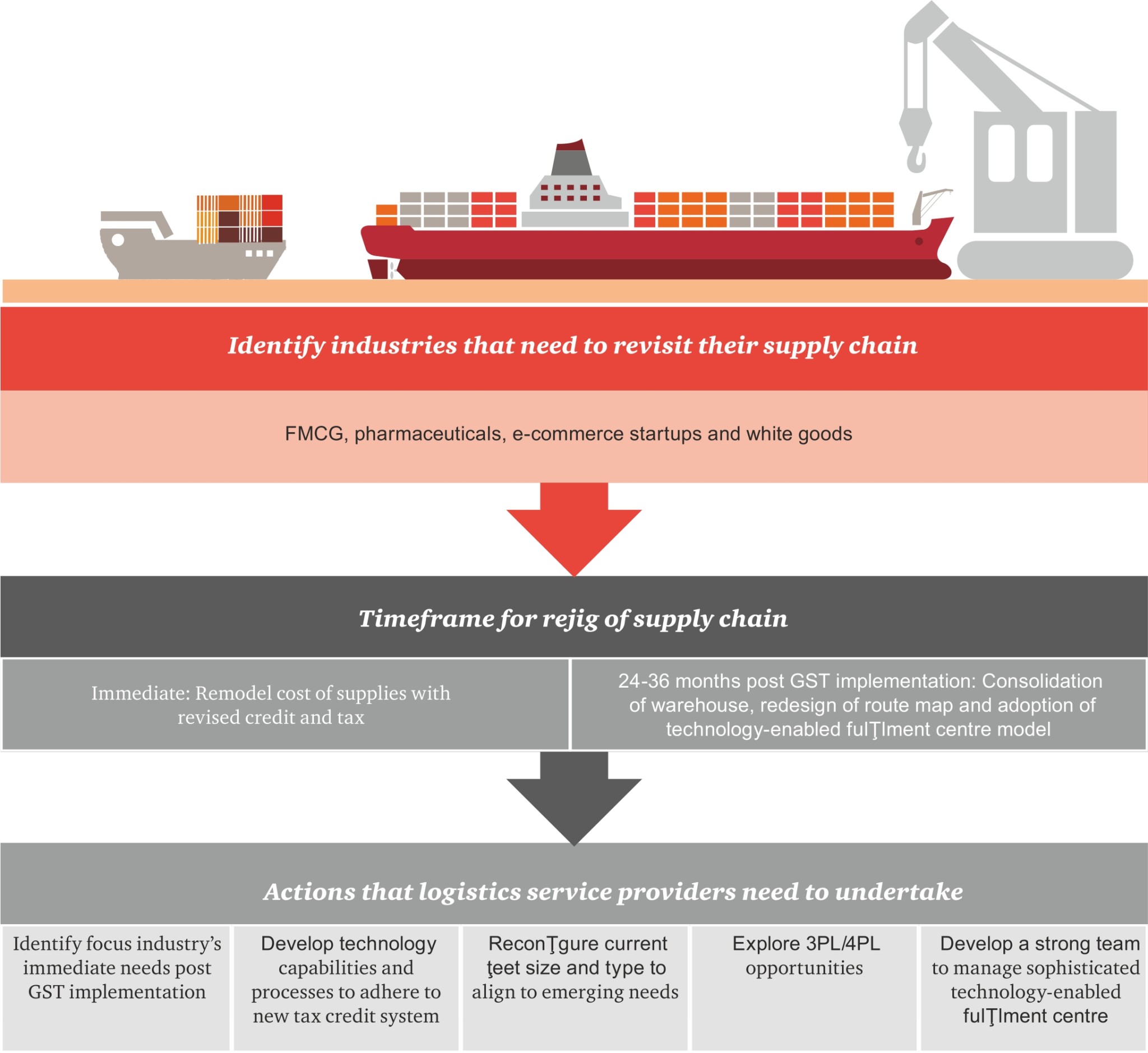

In the medium-to-long term, GST will be a key enabler for businesses to rejig their supply chain, in accordance with various business considerations. Consolidation of warehouses GST presents an opportunity for industry players to consolidate their warehouses and set up larger facilities, which will bring in supply chain efficiencies.

Improved efficiencies due to reduction of trade barriers One of the factors leading to the downtime of vehicles is trade barriers, such as check-post inspection, filing of waybills /entry permits, compliances under Entry Tax laws and local levies. Under the GST regime, the interstate movement of goods will be subject to IGST, wherein all movements will be ‘tax paid’. Additionally, the GSTN will have an audit trail of the movement of goods across the state boundaries.

GST will lead to optimisation of delivery schedules and the operational costs of transporters, resulting in competitive pricing.

Re-evaluation of sourcing and manufacturing decisions

Among other factors, sourcing and manufacturing decisions are presently dependent on indirect tax considerations. In the GST regime, due to fungibility of credits, these decisions shall be made from a supply chain perspective.

E-commerce Under the present indirect tax regime, the e-commerce industry is facing significant challenges. Disputes exist with respect to payment of VAT in the destination states. Some of the states have also levied entry tax on e-commerce goods. Further, the industry has also faced significant bottlenecks due to scrutiny at check posts.

Under the GST regime, it is expected that clear guidelines on the taxability of e-commerce transactions will be issued, providing much-needed relief to the e-commerce industry.

Free Trade Warehousing Zones (FTWZ)

If the GST law extends benefits of tax-free supply to an FTWZ unit for onward exports, the FTWZ units will be able to attract significant volumes.

Supply chain considerations under the GST regime

Supply chain design will be based on demand management and logistical benefits rather than tax costs

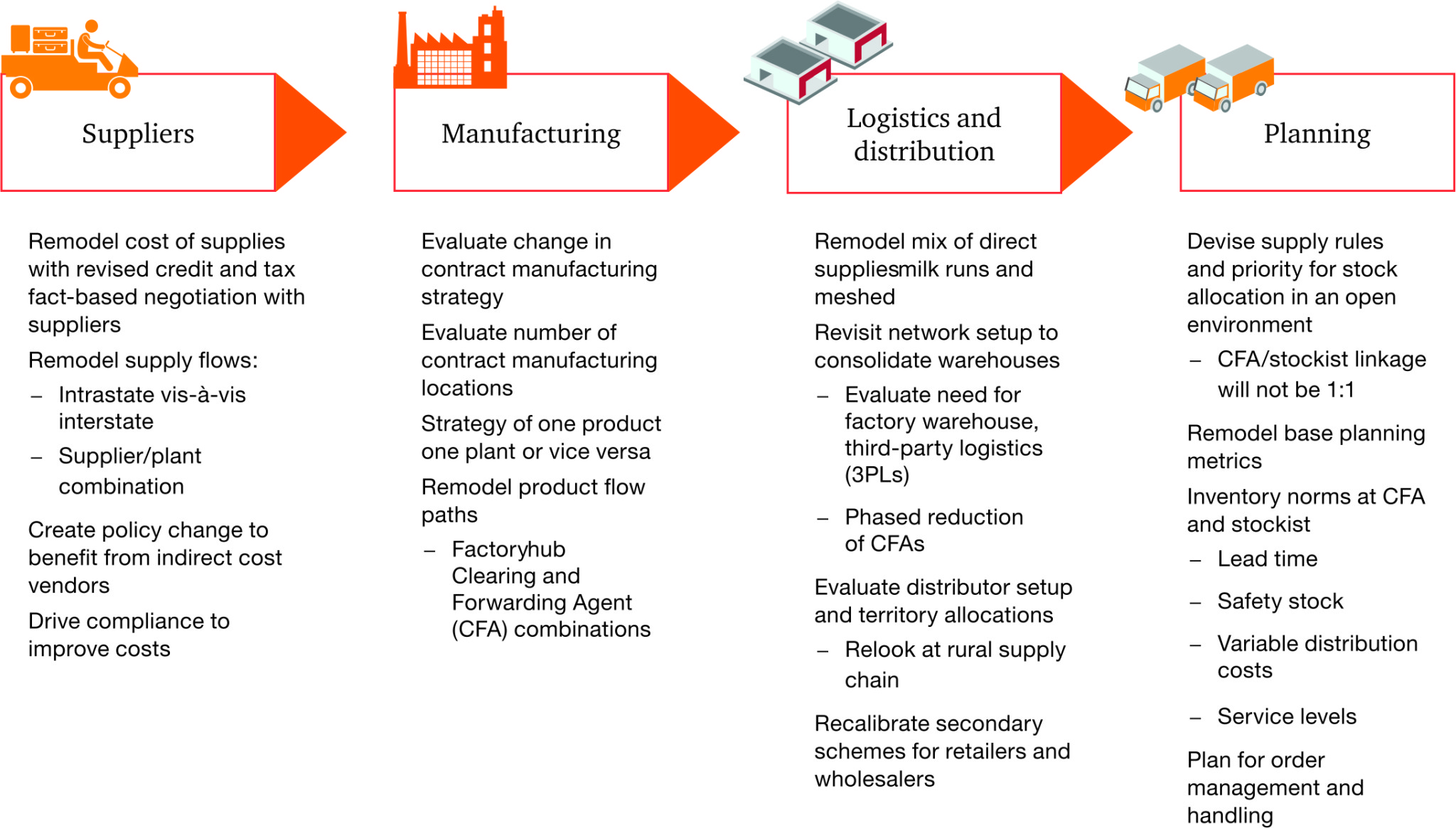

Proactive efforts will create a ‘first-mover’ advantage in the T&L sector. The industry needs to evaluate the following

steps from a supply chain perspective:

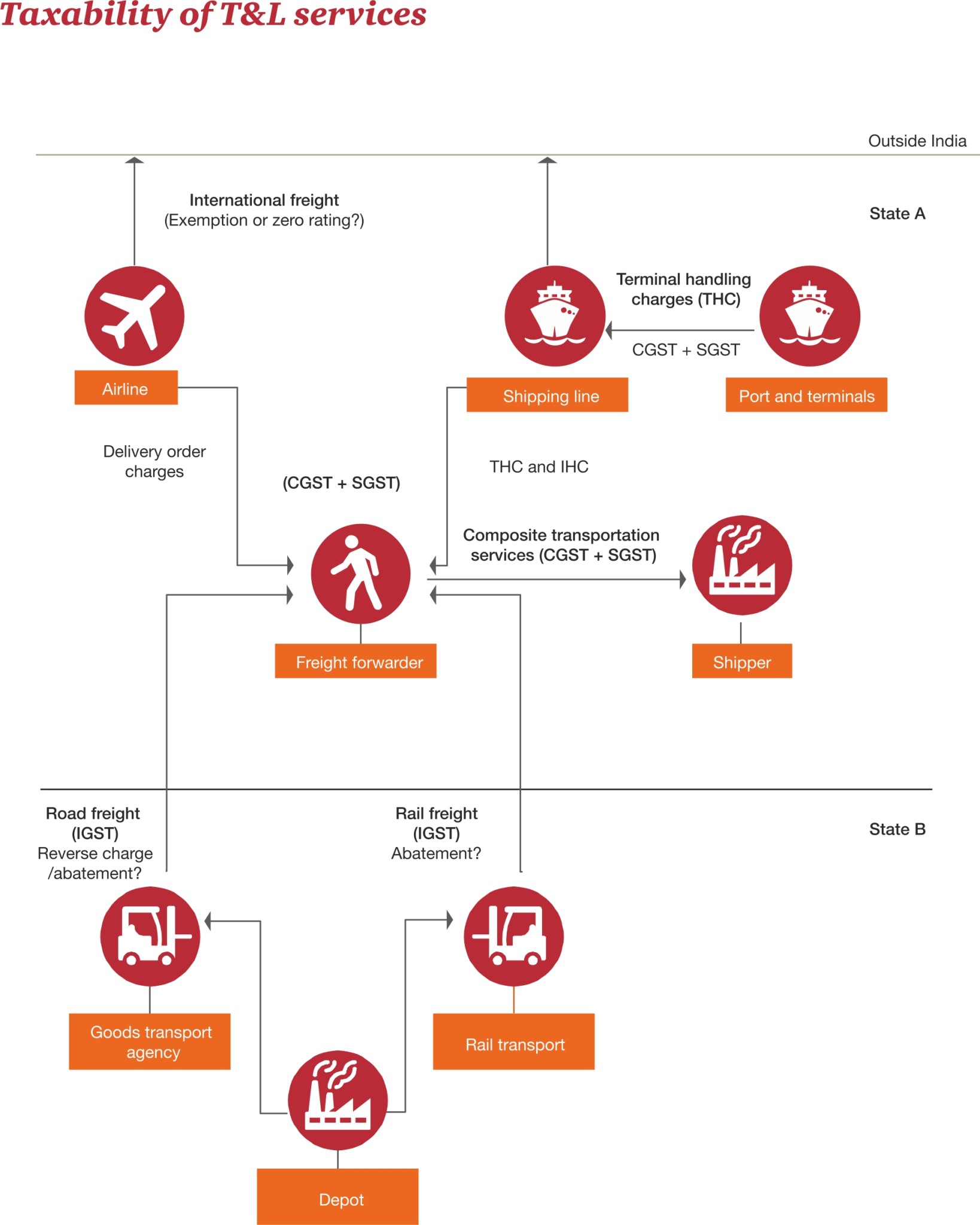

A snapshot of GST compliances

Assumptions:

- It is assumed that the services depicted above are business to business (B2B) services.

- Furthermore, the broad taxability has been determined on the assumption that the service provider has obtained registration in each state where the services are deemed to be supplied.

- The tax implications have been determined on the assumption that the place of supply for the T&L sector will be the location of the service recipient.

Request a consulation at contact form